Who's Buying Medical Real Estate?

Investment demand for all types of medical real estate, including clinical office and outpatient surgical facilities, continues to show no signs of abating. Medical real estate sales in the U.S. surpassed $11 billion in 2019, a figure that has doubled since 2014.

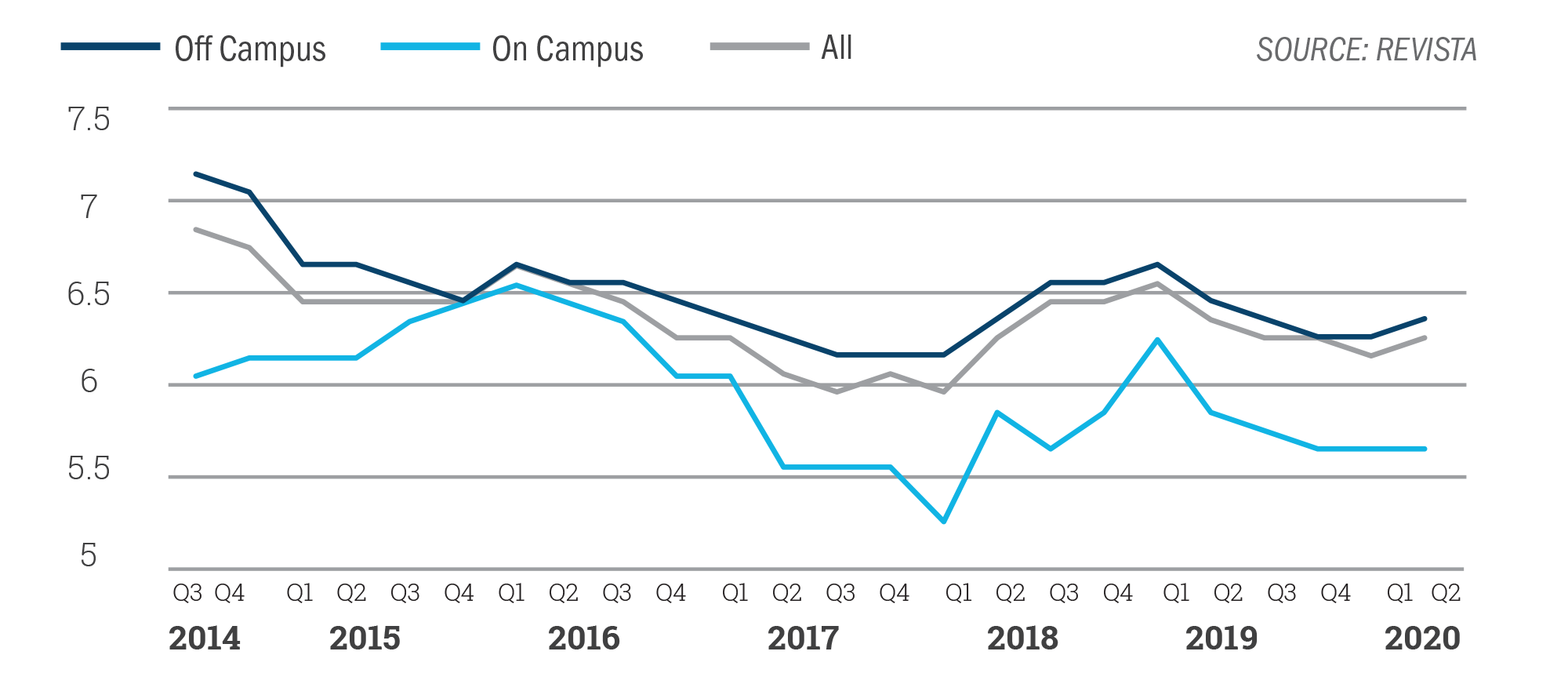

Medical Office Quarterly Average Cap Rate

Transaction volume for healthcare real estate was nearly $5.5 billion in the first half of 2020, up 10% over the previous year, according to Revista, the nation’s leading healthcare data and analytics firm. With medical real estate continuing to show resiliency amid the COVID-19 pandemic, property valuations are at record highs with institutional equity rotating out of other types of commercial real estate sectors, such as office and retail, and into medical real estate where investors see stability, positive demographic fundamentals, and a lower correlation between healthcare expenditures and the broader economy. In fact, current valuations in many cases are exceeding the historically high levels that were seen prior to the pandemic.

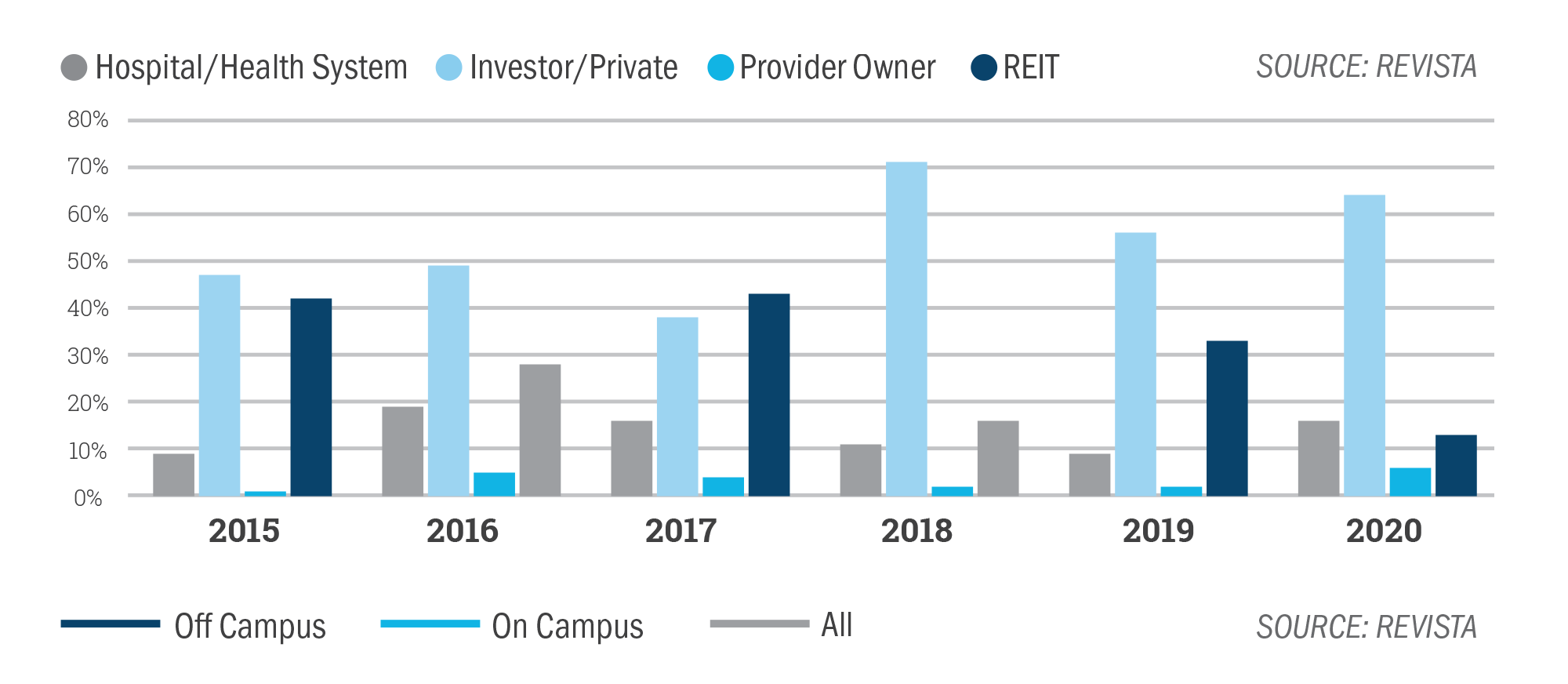

Year-Over-Year Buyer Type

As evidenced in the chart above, over the past several years, Private Equity Groups have been net-buyers (buying more than they are selling), whereas physician-owners of real estate have been net-sellers (selling more than they are buying). What is interesting about the graph, however, is the shifting change in the type of buyer over the past 5 years. Traditionally, REITs have been the most active buyers of medical real estate; however, the REITs have been less acquisitive in recent years, which has been most apparent with physician-led real estate and single-asset transactions vs. portfolio transactions. Private Equity Groups, on the other hand, have filled this void by accounting, on average, for over 65% of the total sales volume from 2017 - 2019. Although REIT stock prices have rebounded in recent months from the large drops at the outset of the pandemic, the REITs have been net-sellers in 2020 as they attend to operational ‘blocking and tackling’ and monetizing non-core assets.

Driving a significant amount of the supply and increase in medical real estate transactions have been physician-owners of ASCs and Surgical Hospitals as these groups address succession planning and explore M&A growth and liquidity options.

Most commonly, this comes in the form of a sale-leaseback combined with continued physician-ownership in the real estate and/or a tax-deferred structure through an UPREIT or §1031 like-kind exchange.

The physician mindset of real estate ownership has continued to evolve as more and more physicians opt-out of real estate ownership and opt-in to practice and ASC ownership. Without addressing a long-term real estate strategy, the ownership alignment between the practice and the real estate has the potential to devolve into disparate ownership. Physician-owners that are aware of this potential outcome have increasingly decided to monetize or partially monetize their real estate to take advantage of the high valuation multiples and to keep their focus on patient care and operational growth opportunities.

Recent Case Study

The Objective:

The original founders of a physician-owned hospital and ASC were interested in monetizing their real estate to prevent a potential imbalance between retiring physicians and incoming physicians but also wanted to maintain a level of control and alignment with the real estate.

The Solution:

HREA’s Hybrid Sale-Leaseback Model allows physicians to monetize 51% - 90% of their real estate ownership in a tax-deferred manner and maintain physician-alignment, maximum control, and future capital commitment for a new MOB.

The Result:

HREA’s discreet marketing process ensured a competitive and transparent bid process generating 15 qualified purchase offers.

The physicians sold 80% of their ownership generating a 16x valuation multiple.

New lease features long-term operational control with no requirement for physician guaranties.

Included additional funding from the real estate partner to expand the campus with a new MOB.

Maintained continued alignment between the practice and the real estate.

HREA News

We are pleased to announce the promotions of three outstanding leaders within our organization. We congratulate Mike, Ryan, and Joe on these well-deserved promotions and look forward to their continued impact and success in their new roles.

HREA | Healthcare Real Estate Advisors is pleased to announce the successful closing of the Positive Steps Fertility Clinic, a purpose-built Medical Outpatient Building located in Madison, MS.

We wish you and your loved ones a very Merry Christmas filled with joy, peace, and warmth. May the New Year bring good health, happiness, and new opportunities for success.

HREA is pleased to announce the successful sale of the Duke LifePoint HOPD, a high-quality, on-campus facility located in Bryson City, North Carolina.

HREA is pleased to announce the successful sale of the Pocono Medical Outpatient Buildings, a multi-tenant medical office park strategically located directly across from Lehigh Valley Hospital – Pocono, a 249-bed acute care hospital featuring ten surgical suites and a 41-bed emergency department.

HREA is pleased to announce the successful sale of Pinnacle Medical Outpatient Building, a 100% leased, Class “A” multi-tenant medical outpatient facility located in Bend, Oregon’s premier healthcare corridor.

HREA is honored to have sponsored the Becker's 31st Annual Business & Operations of ASC Conference, a premier event bringing together leaders and innovators from across the healthcare industry.

HREA is pleased to announce the successful sale of the Atrium Health System Medical Outpatient Building, a Class A facility located in the Blakeney area of Charlotte, North Carolina.

HREA is proud to announce our participation in the 31st Annual Becker’s Business & Operations of ASCs Conference, taking place October 16–18, 2025, at the Swissotel in Chicago, IL.

HREA | Healthcare Real Estate Advisors was proud to be a sponsor and attend the PHA’s 2025 Leadership Summit, held in Santa Fe at the Eldorado Hotel and Resort.

Healthcare Real Estate Advisors Announces Sale of Action Behavior Centers Medical Outpatient Building in Southlake, Texas

Healthcare real estate (HCRE)—particularly medical outpatient buildings, ASCs and Surgical Hospitals continue to stand out as one of the most resilient sectors in commercial real estate at mid year 2025.

HREA | Healthcare Real Estate Advisors is pleased to announce the successful real estate sale of Clinton Park Health Park, a premier Class “A” medical outpatient building located in Clifton Park, NY.

HREA | Healthcare Real Estate Advisors is pleased to announce the sale of a 27,793 square foot outpatient healthcare portfolio in Southlake, Texas.

HREA | Healthcare Real Estate Advisors is pleased to announce the successful sale of two (2) single-specialty Medical Outpatient Buildings (MOBs) located in Kentucky.

Supporting the Future of Spine Care: HREA | Healthcare Real Estate Advisors Sponsors Becker’s Annual ASC Conference.

The Levin HC team recently spoke with Chris Stai, Managing Director at HREA | Healthcare Real Estate Advisors, to discuss their latest transaction involving a Kansas Medical Outpatient Portfolio.

HREA | Healthcare Real Estate Advisors is pleased to announce the successful sale of the HCA College Park MOB Portfolio located in Overland Park.