Who's Selling Medical Real Estate?

As a follow up to HREA’s Who’s Buying Medical Real Estate, it’s worth understanding the breakdown of Who is Selling Medical Real Estate throughout the U.S. along with the circumstances that are driving these transactions.

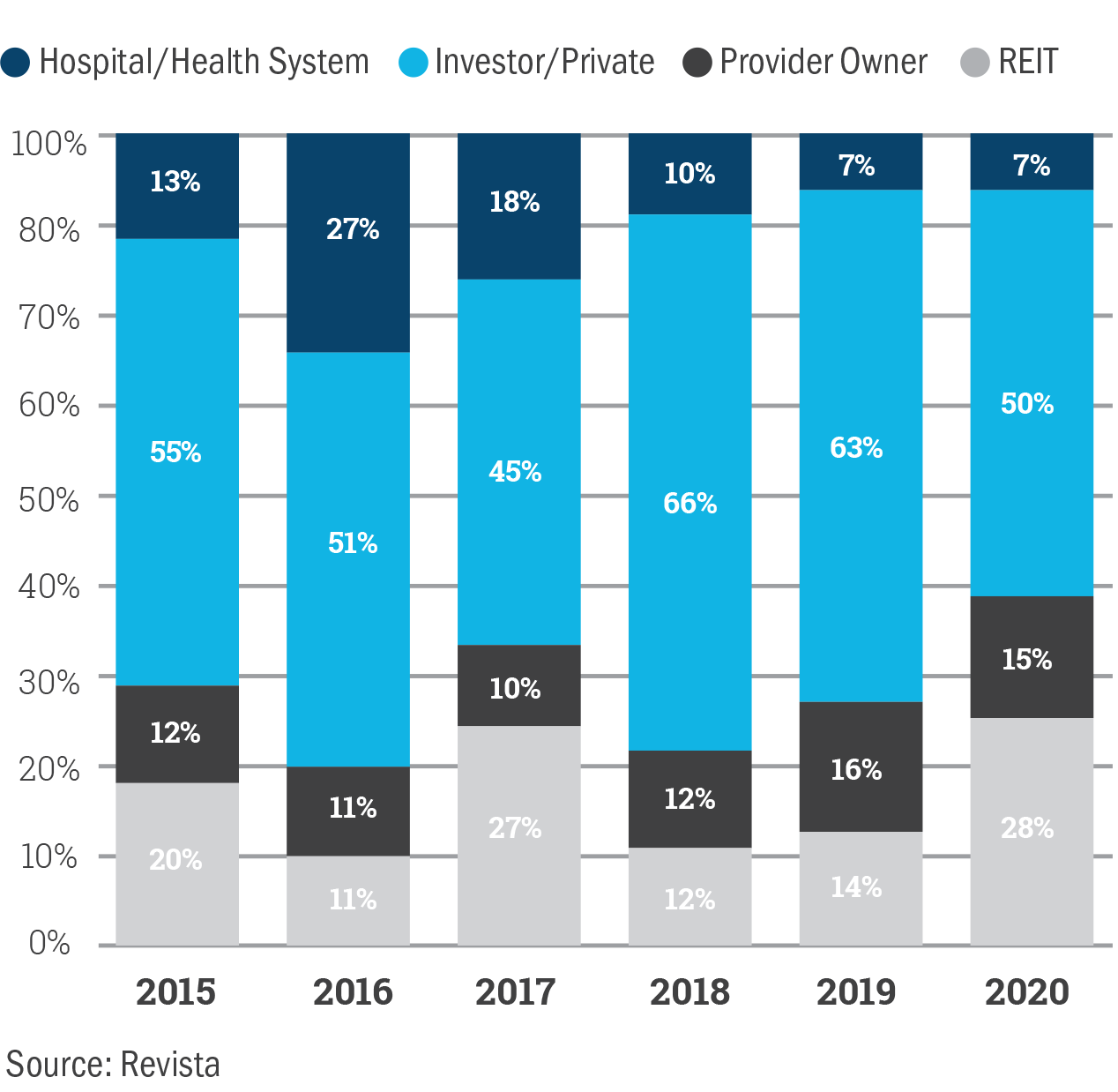

The year-over-year sale volume activity depicts a consistent increase of real estate transactions by physician-owners. Whether addressing succession planning or capitalizing on historically high valuations, physician practice groups are deciding to explore various liquidity strategies, and in particular, the Hybrid Sale-Leaseback, which allows for both a sale and continued physician-ownership in the real estate.

Providers who own and occupy their medical real estate are increasingly seeing the benefits from selling or partially selling and unlocking the value that has been created from their practice, achieving unprecedented valuations ranging from 15x – 18x EBITDA. This compares favorably to the multiples that are being achieved by monetizing their practice operations by a factor of nearly 2 times.

Another common trend we are seeing is private equity investors making up over 50% of the sales volume.

This is primarily due to these investors aquiring indivdiual assets and rolling them into a large medical portfolio that will eventually be sold to a REIT or larger private equity group. HREA’s knowledge to discern between long-term patient capital and short-term “flip” mentaltity is invaluable.

% of Sale Volume by Ownership Type

HREA News

HREA | Healthcare Real Estate Advisors is pleased to announce that Joe Karnes has joined the company as a Senior Associate in its Denver office.

In 2023, HREA’s team of professionals advised on the sale of 22 healthcare real estate assets throughout the U.S totaling $245 million in transaction volume. With a primary focus in representing healthcare providers, HREA leverages its unique experience in the industry by navigating advanced transaction structures that are tailored to each client’s goals and objectives, including a variety of tax-deferred structures.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of a multi-specialty outpatient surgery located in Effingham, IL. Effingham Surgery Center consists of 17,201 rentable square feet and is 100% leased and occupied by the practicing physicians in partnership with USPI and Sarah Bush Lincoln Health System.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of Specialists Hospital Shreveport (“Hospital”), a physician-owned surgical hospital, and four (4) affiliated medical office buildings, totaling approximately 192,640 square feet (“Portfolio”).

HREA | Healthcare Real Estate Advisors was honored to attend and sponsor the Becker’s 29th Annual Meeting: The Business & Operations of ASCs at Swissotel in Chicago, Illinois.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of seven (7) single-specialty medical office and outpatient surgery centers located throughout northwest South Carolina.

HREA | Healthcare Real Estate Advisors is proud to be a sponsor of the Becker’s 29th Annual Meeting, The Business & Operations of ASCs.

HREA | Healthcare Real Estate Advisors and Realti Ventures is pleased to announce the real estate sale of a single-specialty medical office building portfolio located in Rock Hill, SC, Fort Mill, SC, and Lancaster, SC. The portfolio is 100% leased to Carolina Cardiology Associates (“CCA”) and consists of 25,258 square feet.

HREA | Healthcare Real Estate Advisors, along with Merritt Healthcare Advisors, title sponsored the PHA’s 23rd Leadership Summit at The Boulders Resort in Scottsdale, Arizona.

Discover how collaborative partnerships with investment banking and real estate experts can lead to optimal financial and non-financial M&A outcomes in our new white paper.

One of the common topics we hear from our clients are the challenges of succession planning involving the real estate. Partnering with HREA ensures a smooth transition when considering the sale or partial sale of your medical real estate.

HREA | Healthcare Real Estate Advisors, a national leader in providing healthcare real estate advisory and capital market solutions, is pleased to announce that Timothy J. Cajka has joined the company as Director of Investment Sales.

HREA | Healthcare Real Estate Advisors is proud to be a sponsor of the Becker’s 20th Annual Spine, Orthopedic + Pain Management-Driven ASC Conference, which is being held in Chicago from June 15th, 2023 through June 17th, 2023.

HREA | Healthcare Real Estate Advisors, a national leader in providing healthcare real estate advisory and capital market solutions, is pleased to announce that Mike Spisak has joined the firm as Director of Healthcare Real Estate - Investment Sales.

HREA’s Private Client Group consists of specialized Net-Lease and §1031 Exchange professionals that offer access to a large pool of §1031 exchange and private capital buyers that specifically target net-leased medical properties.

HREA | Healthcare Real Estate Advisors is pleased to announce that Anthony Naticchioni has joined the firm as Director of Healthcare Real Estate Investment Sales. Located in Orange County, California. Anthony serves HREA’s clients by advising and executing financial and real estate strategies that address both the operational aspects of the practice or surgery center and the real estate.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of a multi-specialty outpatient surgery located in Corbin, KY. The single-tenant ASC consists of 16,354 rentable square feet that is 100% leased and occupied by the practicing physicians in partnership with Baptist Health.

The HREA team would like to express our sincere appreciation to our clients and partners for making 2022 a successful year. We greatly value our relationship and wish you a healthy and successful 2023. HREA’s team of professionals advised on the sale of 22 healthcare facilities throughout the U.S., totaling $365 million, including physician-owned hospitals, ASCs, and Medical Office Buildings.

HREA | Healthcare Real Estate Advisors has announced the sale of an 11-property medical office portfolio located in eight states for a total value of approximately $130 million.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of West Valley Medical Plaza located in Goodyear, AZ. West Valley Medical Plaza is a multi-tenant medical office building and outpatient surgery center that is conveniently located approximately 20 miles west of Phoenix Sky Harbor International Airport.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of Copper Peak Medical Building located in American Fork, UT. Copper Peak Medical Building is a multi-tenant medical building that was built in 2004 adjacent to the affiliated American Fork Hospital.

HREA | Healthcare Real Estate Advisors is pleased to announce the real estate sale of a medical office building located in Arlington, TX. The building was originally built as a build-to-suit for TMI Sports Medicine & Orthopedic Surgery providing high-quality orthopedic care to the residents of Arlington and the greater Dallas Metro area since 2004.